The 18th-century thinkers behind laissez-faire economics saw slavery as a great example of global free trade

by Blake Smith

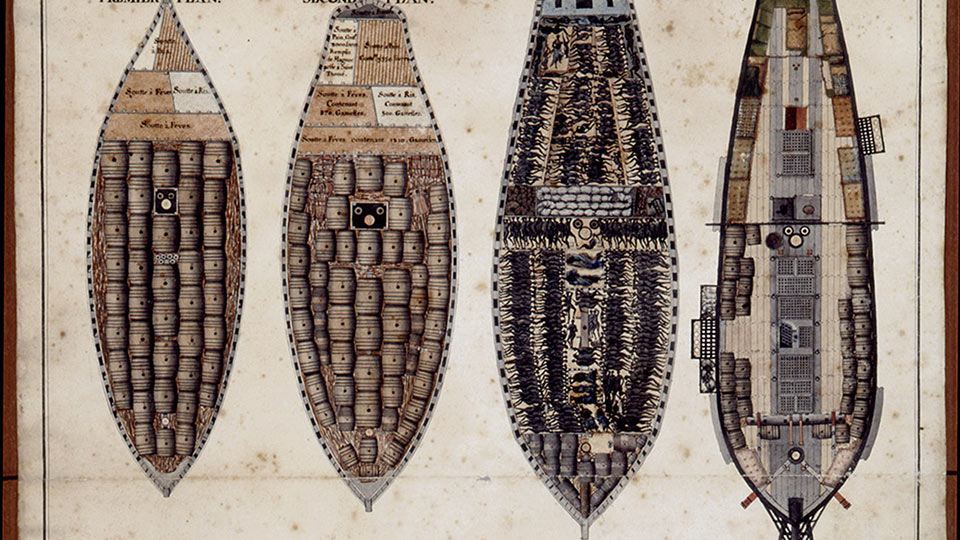

For nearly four centuries, the Atlantic slave trade brought millions of people into bondage. Scholars estimate that around 1.5 million people perished in the brutal middle passage across the Atlantic. The slave trade linked Africa, Europe and the Americas in a horrific enterprise of death and torture and profit. Yet, in the middle of the 18th century, as the slave trade boomed like never before, some notable European observers saw it as a model of free enterprise and indeed of ‘liberty’ itself. They were not slave traders or slave-ship captains but economic thinkers, and very influential ones. They were a pioneering group of economic thinkers committed to the principle of laissez-faire: a term they themselves coined. United around the French official Vincent de Gournay (1712-1759), they were among the first European intellectuals to argue for limitations on government intervention in the economy. They organised campaigns for the deregulation of domestic and international trade, and they made the slave trade a key piece of evidence in their arguments.

For a generation, the relationship between slavery and capitalism has preoccupied historians. The publication of several major pieces of scholarship on the matter has won attention from the media. Scholars demonstrate that the Industrial Revolution, centred on the mass production of cotton textiles in the factories of England and New England, depended on raw cotton grown by slaves on plantations in the American South. Capitalists often touted the superiority of the industrial economies and their supposedly ‘free labour’. ‘Free labour’ means the system in which workers are not enslaved but free to contract with any manufacturer they chose, free to sell their labour. It means that there is a labour market, not a slave market.

But because ‘free labour’ was working with and dependent on raw materials produced by slaves, the simple distinction between an industrial economy of free labour on the one hand and a slave-based plantation system on the other falls apart. So too does the boundary between the southern ‘slave states’ and northern ‘free states’ in America. While the South grew rich from plantation agriculture that depended on slave labour, New England also grew rich off the slave trade, investing in the shipping and maritime insurance that made the transport of slaves from Africa to the United States possible and profitable. The sale of enslaved Africans brought together agriculture and industry, north and south, forming a global commercial network from which the modern world emerged.

It is only in the past few decades that scholars have come to grips with how slavery and capitalism intertwined. But for the 18th-century French thinkers who laid the foundations of laissez-faire capitalism, it made perfect sense to associate the slave trade with free enterprise. Their writings, which inspired the Scottish philosopher Adam Smith’s Wealth of Nations (1776), aimed to convince the French monarchy to deregulate key businesses such as the sale of grain and trade with Asia. Only a few specialists read them today. Yet these pamphlets, letters and manuscripts clearly proclaim a powerful message: the birth of modern capitalism depended not only on the labour of enslaved people and the profits of the slave trade, but also on the example of slavery as a deregulated global enterprise.

For centuries after European colonisation of the Americas commenced, European governments regulated the Atlantic slave trade. They organised it in accordance with what was known as mercantilism. This was the authoritative economic thinking of the 16th, 17th and much of the 18th century. It favoured heavy government intervention, particularly in international trade. For mercantilist thinkers, trade was a kind of war in which nations could defeat their rivals by accumulating silver and gold, and by exporting manufactured goods while importing agricultural products. All aspects of trade were to be precisely organised in order to serve these goals, leaving little initiative to private traders. A few decades after Christopher Columbus’s arrival in the Caribbean in 1492, it became clear to the Spanish monarchy that enslaving indigenous peoples of the Americas was not enough to supply its growing colonies’ need for labour. The Spanish turned to the slave trade in West Africa. Europeans and Arabs had long engaged in the African slave trade. Well-meaning Spanish critics of the horrific mistreatment of indigenous peoples, such as Bartolomé de las Casas, supported this decision. They argued that Africans were better fit for hard labour than American Indians.

In a system known as the asiento (contract), the Spanish government began granting some European merchants special monopoly contracts. These allowed the traders to become the sole merchants permitted to sell slaves in a particular area. The Spanish government carefully controlled the whole economy of its American colonies, only allowing a select handful of foreigners to trade with its valuable possessions. Since the slave trade was one of the most lucrative sectors of colonial commerce, it was particularly restricted. In the 16th century, the Spanish government granted these asiento monopolies over the slave trade in its colonies to Italian, German and Portuguese investors who came from countries in the orbit of Spain’s global empire. By the end of the 17th century, however, Spain was declining as a military power. It was less and less able to grant the asiento to merchants of its own choosing. Other European empires coveted the riches of the asiento for themselves, and tried to seize it. In 1701, the Spanish king died with no heir. The French king, Louis XIV, invaded Spain and installed his own grandson on the throne. One of the newly crowned ruler’s first acts was to hand over control of the asiento to his grandfather. Now France would have the sole right to supply Spain’s colonies with enslaved Africans, ensuring huge profits for French slave traders.

The asiento was a rich prize, and France was not the only country to covet it. Louis XIV’s enemies quickly snatched it back from him. Great Britain, the Netherlands and a number of other countries formed an alliance against France, initiating the War of the Spanish Succession (1701-1714). This ended in French defeat. As part of its share of the spoils of war, Britain took control of the asiento. In order to run this valuable new commerce, it created an innovative corporation called the South Sea Company. This was one of the first joint stock companies to attract thousands of investors, who imagined that the profits of the slave trade to the Spanish colonies made it a sure bet. The price of shares spiralled ever higher, until the frenzy of speculation triggered a nationwide financial crisis. Shocked by the sudden rise and disastrous fall of the value of their shares, bewildered investors discovered the stock-market ‘bubble’, the first of its kind.

More slaves in the colonies meant more consumption of sugar, coffee and chocolate in Europe: feeding on itself, the slave trade seemed to expand without limits

While the British public was trading shares in the slave trade, French slave traders faced an uncertain future. The end of the War of the Spanish Succession deprived them of access to what had been their best markets. They demanded action from the government. But the French government had financial problems of its own. The war left it burdened with massive debts and desperate for a way out. It turned to the professional gambler-turned-business guru John Law (1671-1729), who promised that a new twist on mercantilist polices would solve the problems of both the state and of slave traders. On his advice, the French monarchy created a new state-run corporation, the French East India Company. This behemoth had global ambitions. Headed by Law himself, it had a monopoly on all trade between France and Asia, and also the exclusive right to supply France’s sugar-producing colonies in the Caribbean with African slaves. The initial excitement of Law’s scheme, like initial excitement in Britain over the South Sea Company, led to wild speculation by the public on shares of the new company. When the price of these shares rose far enough beyond their real value, it finally collapsed, bringing Law, his company and the French economy into ruin.

With yet another economic crisis on its hands, the French government took a desperate, unprecedented step. In defiance of mercantilist ideas, it deregulated the slave trade. For the first time, the monarchy allowed private firms to send slave ships to Africa and on to the Americas. There would be no new state monopoly company to control the French slave trade. From a business perspective, the result was a wild success. Private traders sent increasing numbers of slaves to France’s colonies of Martinique, Guadeloupe and Saint-Domingue (now Haiti). At the beginning of the 18th century, a few thousand slaves were brought to the French Caribbean each year. By the end of the 18th century, more than a 100,000 slaves were taken there annually. The huge increase in the volume of slaves coming to France’s colonies transformed these islands into centres of global commerce. The more that traders sent slaves to the colonies, the more colonial plantation owners could expand their production of sugar. The cheaper sugar became, the more a growing number of Europeans could consume it, often paired with other colonial substances such as coffee and chocolate. These were also produced in tropical colonies by enslaved Africans. More slaves in the colonies meant more consumption of sugar, coffee and chocolate in Europe, and thus also meant even more demand for slaves. Feeding on itself, the slave trade seemed to expand without limits.

This economic boom was a human tragedy. Slavery was brutal everywhere in the Americas, but slavery in France’s sugar plantations might have been the most brutal of all. Many enslaved Africans died before reaching the Caribbean colonies and, once they arrived, their average life expectancy was less than five years. They were simply worked to death. It was no accident that Saint-Domingue, the largest French colony, would be the scene of the most important and most violent slave revolt in the history of the Americas. Breaking out in the midst of the French Revolution, this revolt forced the French government to abolish slavery in 1793. When France began to attempt to restore slavery 10 years later, a new revolt broke out. This time, the rebels won their independence from France, creating the Republic of Haiti in 1804.

While tensions brewed in Saint-Domingue, the enormity of the Atlantic slave trade slowly began to register on French consciences. In the 1780s, on the eve of the French Revolution, anti-slavery activists gathered in Paris to lobby for the abolition of the slave trade. But a generation before this, another group of activists known as the Gournay Circle were more concerned about the lessons that the growing slave trade had for the French economy. They were inspired by Gournay, the intellectual who coined the phrase laissez-faire, laissez-passer (‘let do, let go’) to sum up his innovative views.

Gournay and his entourage revolutionised economic thinking by calling for the systematic elimination of international and domestic trade barriers such as state monopolies, guilds and prohibitions on foreign imports. Never before had a group of thinkers so directly challenged mercantilist ideas. When the French monarchy had deregulated the slave trade in the 1720s, it had acted out of desperation in regard to a particular crisis, not out of a conviction that mercantilism itself had failed. It was only three decades later that members of the Gournay Circle observed the dramatic growth of the slave trade and slave-based colonial economies, and drew a more general conclusion. They argued that the slave trade’s success proved that deregulation should be pursued not just as a last-ditch tactic, but as a deliberate and comprehensive strategy. The slave trade showed that the top-down regulations of mercantilism were obsolete.

The Gournay Circle lobbied the French monarchy for sweeping changes. One of its most important targets was the French East India Company, the successor to Law’s ambitious super-corporation. Deprived of its monopoly over the French Atlantic slave trade in 1720, this state monopoly company was now responsible for all French trade with the Indian Ocean region. No private traders were allowed to sail east past the Cape of Good Hope. The Company managed to make a reasonable profit most years. However, it neither satisfied French demand for South Asian commodities nor exported more than a handful of French goods to South Asia. It ran a massive trade deficit and, by the middle of the 18th century, was sinking into debt.

Sensing an opportunity to advance their ideals of laissez-faire, Gournay and his circle attacked the Company. They compared the unsatisfactory state of France’s trade with the Indian Ocean to the flourishing and ever-expanding Atlantic slave trade. The first revealed the weaknesses of mercantilism, while the second showed the strengths of laissez-faire. Gournay first developed this argument in a series of unpublished Observations on the Company written in the mid-1750s. He wrote that ‘the largest branches of commerce that the nation [France] has acquired since 1720… have been obtained only by parting from the Company’s privilege’. In the Atlantic market, where Law’s Company had lost the right the monopolise trade, business boomed. In the Asian market, where the Company’s successor still had a monopoly, trade languished. Gournay pointed to the growth of France’s Caribbean colonies after the deregulation of the slave trade. He noted that ‘the islands of Saint Domingue and Martinique would still be almost entirely without Negroes and thus without agriculture’ if the monarchy had not deregulated the slave trade.

Gournay died not long after making these comments, but his protégé André Morellet (1727-1819) picked up where he left off. Morellet became the spokesman for a movement against the French East India Company. In 1769, he published the incendiary pamphlet On the Current Condition of the India Company, which included Gournay’s notes in his own text, and expanded on their themes. Morellet insisted that state enterprises in general should be abolished, and cited the success of French slave traders after 1720 as proof of the superiority of laissez-faire over mercantilism. To those who felt that the deregulation of France’s trade with Asia was too risky, he answered: ‘This pretext is always relied on in the creation of monopoly Companies, and notably in the trade in Negroes on the African coast … However since then it has been observed that this competition, far from destroying commerce, sustained it. The French colonies in America had remained, until then [1720], in a state of great weakness; liberty revived them.’ Liberty, of course, meant in this case the expansion of the slave trade. Colonial slavery was a force for economic freedom.

Morellet reasoned that the slave trade proved Africans were equal to Europeans. Self-interest motivated both groups to sell or purchase enslaved people

It is a grotesque irony that this pioneering free-trader could equate ‘liberty’ and the slave trade, but Morellet was not finished yet. Defenders of the Company argued that South Asia was so different from Europe that private traders would be unable to carry out business there. Only a monopoly company, they claimed, could afford to hire experts familiar with the region’s languages, cultures and geography. They warned that private traders would be unable to hire such experts, and would arrive in South Asia unable even to communicate with their local counterparts. The example of the slave trade, Morellet countered, showed that such arguments were false. After 1720, private traders from French ports began to arrive in West Africa. They had no experience of local cultures, yet African merchants and political leaders soon brokered contracts.

In spite of vast linguistic and cultural differences, French traders were able to purchase slaves in exchange for textiles, guns, tools and other items. Business would find a way to overcome any difference between diverse peoples. Indeed, the slave trade proved that Africans and Europeans were, at least in economic terms, exactly alike, hardly different after all: ‘the truth is that, on the subject of trade, people… act in the same way, because they are all guided by the same principle, that is to say, by interest’. Morellet reasoned that the slave trade proved Africans were equal to Europeans. Self-interest motivated both groups to sell or purchase enslaved people.

Morellet and his fellow free-traders’ campaign against the French East India Company, based on the example of the successfully deregulated Atlantic slave trade, was a triumph. They celebrated the deregulation of France’s trade with Asia in 1769. This victory, in turn, inspired economic thinkers across Europe to consider how laissez-faire principles could be applied to other markets. Morellet’s call for freedom of trade particularly struck Adam Smith, who referred to Morellet extensively in The Wealth of Nations (1776), a landmark text that still informs many people’s belief in the ‘free market’.

Indeed, Smith became far more influential than his teacher. As his own version of laissez-faire ideas came to seem like common sense in the following century, the pioneering Gournay Circle was largely forgotten. Their sense that the slave trade was a prime example of free trade in action disappeared. Yet the writings of Gournay and Morellet reveal that modern capitalism is entangled with slavery in multiple, profound ways. Slave labour supplied the cotton, sugar and other vital commodities. The profits from the sale of slaves created fortunes on both sides of the Atlantic. And, in a disturbing paradox, the founding fathers of laissez-faire saw the slave trade as a showcase of liberty.